6 Things to Consider When Deciding to Buy a Used vs. New Boat

The new shiny one or the often thought of more practical used version? New versus used is an age-old decision for boat buyers. No doubt a used boat will be less expensive for the same model, but questions arise, such as:

How much less expensive?

What should I be considering?

Is the gap closer than I first thought?

In this article we will run a comparison on a boat near and dear to my heart, the Beneteau Oceanis 30.1, which I own a 2021 version. A search in Yachtworld returns two identical models, one new in 2024 and the other used from 2019, with mostly comparable features. You can also open up our New vs. Old Calculator available under the Downloads section or by clicking here.

At first glance it seems somewhat obvious: one costs twice as much as the other for 5 years of age difference, so if I don’t have an extra $115,000 laying around, I should probably look to the used boat. However, the difference is all a matter of perspective:

Upfront Cost Difference: If we think about the day one difference, that is how much we will actually spend on the day we buy the boat, we can show that it could be less than $10,000 in our example (~$6,511 per our calculations).

Total Cost of Ownership (“TCO”): The upfront cost difference is a bit misleading, particularly after costs start accruing over time. However, this isn’t straightforward, and we find that the gap between new vs. used goes down by almost 30%!

What is causes these difference? The six major things to consider are:

1) New Boat Discounts

A simple concept, but one that I personally didn’t appreciate until I negotiated my first boat purchase. Just like used prices can move based on supply and demand, so can new boat discounts when purchasing through a manufacturer’s dealership. These can range from 5% to 10% depending on inventory and demand, but that translates into tens of thousands of dollars off the purchase of a new boat.

For purposes of our example, where the new boat is $230,000, let’s assume the dealer gives us a 5% discount, which drops the price by $11,500 to $218,500. No some readers will say that the used market we can also negotiate down, but in this instance the $115,000 was after a recent price drop, so we will hold it at that level.

2) Financing

Most buyers will take a loan out to buy their boat and they will encounter significant differences for a used versus a new boat. If you need help with understanding how boat loans are calculated download our Boat Loan Calculator under the Downloads section or click here.

For financing we must first differentiate between two types of lending:

a) Secured: this is a loan based on the value of the boat. It’s generally a better value for newer boats as they have a higher value and better residual estimation. We will see that used boats have more punitive considerations for secured loans, which sometimes push people towards unsecured loans.

b) Unsecured: an unsecured loan is a loan against your personal ability to pay. It’s typically a calculation of how much cash flow you must pay the loan after considering your income and all your other debts. Typically, these loan amounts are lower than secured loans and incur higher cost.

Let’s assume that we take the more common path of a secured loan; what are the differences between the new boat and the used?

i) Loan Amount: a new boat should be able to obtain the highest possible loan to value ratio. This is typically 80%. As vessels age the amount a bank is willing to loan goes down. In our example we assume a secured borrower could only get 70% of debt against the vessel value.

ii) Loan Rate: the financing cost of a new vessel is typically less than a used one. The rationale goes back to risk, where a used vessel is thought to be riskier with expenses and potential variations in market value.

iii) Loan Tenor: the tenor is the amount of time the bank will let us pay the loan back. In any asset based loan the bank often looks to the useful life of the asset as the upper limit for loan tenor. In most cases the banks will actually want some buffer and ensure that the loan is paid off before the useful life. For new boats we can usually get up to 20 years of tenor, but a rule of thumb is to take each year of age from the useful life to get the loan tenor (in our example the used boat is 5 years older, so we assume a loan that is 5 years shorter in tenor at 15 years).

Let’s visualize these two examples since there are interesting take aways. Below are graphs that show the balance of the loan over time (blue shaded area) and the total cash flow out or payments (orange line). What’s interesting is that although there is over $100k in purchase price difference, we likely will not get the same percentage of debt versus boat value and will have to put more of our own cash up front. The difference in upfront cash in this example is only $11,500 ($230k new price - $184k debt = $46,000 equity) versus ($115k used price - $80,500 debt = $34,500 equity).

But be careful thinking, “Oh, that’s great, let’s go get a new boat as it’s only an extra $11.5k!” The issue is that the new boat loan balance is much higher, meaning the payments are going to be higher. Look at the difference in the orange lines (when the line is flat). Virtually a 2x ongoing loan outflow.

New Boat - loan balances and payments over time with assumed sale in year 10

Used Boat - loan balances and payments over time with assumed sale in year 10

3) State Sales Tax

This is a bit of a “trick” topic as state sales tax will generally apply in both a new and used boat purchase. Many used purchasers for some reason are surprised by this, but it mostly follows similar rules as other vehicle purchases such as cars.

That being said there are variations by state and in some cases there are caps that limit the amount of sales tax on boats. Therefore, the effect can vary depending on state and the cost of the boat.

4) Other Upfront Costs

There are a couple of sneaky costs to used boats that people off find out too late: marine surveyor and delivery costs.

a) Marine Surveyor Costs: Unless you are a seasoned marine surveyor or engineer, you will need to hire one when you buy a used boat. There are several subtleties when looking at repair work, engines, electric systems, etc. that a marine surveyor will instantly see, understand, and quantify for you. This can save you thousands in the long run, but you will have to pay for their services. Assume at least $1,000 for a typical 30ft sailboat.

b) Delivery Costs: With new boats you typically interact with a regional or local dealership. They will often be within 50 miles meaning you can typically sail the boat back to your home port easily. With used boats the locations are listed in the sales advertisement. Hiring someone to move a boat can get expensive and varies tremendously depending on boat type, size, and distance. In our example we assumed we could trailer the Oceanis 30.1 (one version has this capability) and assumed $2,000 for transit costs.

5) Depreciation

Depreciation always confuses people as it’s a cashless expense, until it turns into resale value and becomes real. The loss in asset value over time is depreciation and it can vary depending on supply and demand. During the COVID-19 pandemic everyone wanted a socially distanced sport, and possibly an exit strategy, so used boat values were very high, meaning depreciation was low.

Fortunately (or unfortunately for used boat owners) that is not the norm, and typically a new vessel will depreciate in an imbalanced way, with a lot of depreciation in the first few years. It’s just like a car, the minute you take it from the dealer it drops in value.

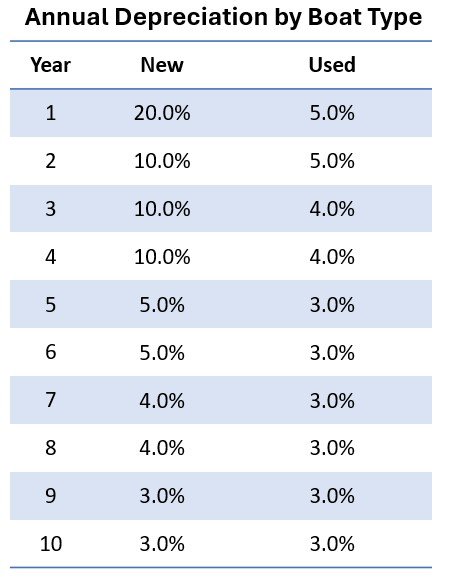

The table below shows our assumptions for the new boat versus the used and how depreciation is accelerated early on for new boats.

Depreciation by new or used boat. Percentages represent decrease in value of boat against running annual value

6) Annual Running Costs

The last major item to consider are annual running costs, where there are common items like docking, cleaning, and winterization (depending on geography). Many often say that one can expect 10% of the vessel cost in annual expense, which is not too far off my own experience. However, the core difference between a new and used boat are maintenance costs.

New vessels have most major items under warranty for a few years. Given every component is new there is minimal repair maintenance, assuming normal use. However, as vessels age, we tend to hit what I call the $2,000 rule. Everything seems to cost $2,000 to repair. For this reason, we assumed an additional $2,000 per year for a used vessel.

The other consideration, which is more for power boaters is fuel efficiency. As engines age they become less fuel efficient with small leaks, breakdowns, etc. For sailboats its usually a small factor, but for a powerboat this can become a real issue.

Nautilys offers a Ongoing Costs Calculator under the Downloads section or by clicking here.

So Which Do I Choose? New vs. Old?

Boat owners should look to the total cost of ownership as it is the most relevant for them in the long run. There are several arguments that support new boat purchasing, but if it’s absolute cheapest entry price, it will be difficult to beat a used boat. The counter arguments to the lower cost are:

a) The latest design, performance and safety equipment, which can be an experiential factor. There is a premium that some will pay to have a boat set up exactly as they like and also having the comfort factor with the most up to date safety equipment.

b) Time spent boating versus repairing. Undoubtedly the further back in time you go on a boat’s age, the more work you will have to do each year to keep the boat operating. Newer boats let you enjoy more time on the water.

c) Lastly, there is one more consideration that we have developed an entirely separate calculator and article for: Sailtime / Powertime. These are fractional use programs that typically only allow new boat owners to put their boats into service. These programs significantly reduce operating costs to the level where an owner may actually earn money off their boat. It’s a game changer for the new versus used equation, which we will look at in a separate Analysis blog and with a detailed calculator available in the Downloads section or by clicking here.